There are many types of bank accounts that people can choose from. Most common types of bank accounts includes checking accounts, savings accounts and fixed deposit account. Today, we will focus mainly on the detail discussion of savings accounts. Our topic is based on “How do banks make money on savings accounts?”.

Topics Covered In This Article:

- What is Saving Accounts and What are the Benefits of It?

- Savings Accounts vs. Checking Accounts

- Types of Interest Rates

- How Do Banks Make Money on Savings Accounts and Checking Accounts?

- How to Determine the Annual Percentage Yield (APY) for a Savings Account?

- Which Account is Beneficial for Banks: Savings Accounts or FD Accounts?

Now, let’s have a detailed understanding about bank saving accounts. First, let me explain what is saving accounts.

What is Saving Accounts and What are the Benefits of It?

A saving account is a type of bank account that provides the account holder with a fixed interest rate. It is one of the most popular types of bank accounts and can be used to save money over time.

Saving account is a type of bank account which usually pays a higher interest rate than a checking account and it typically requires a larger minimum deposit. It also allows people to withdraw money, but there are limits on how often they can do so, which makes them more secure for storing money for long periods of time.

5 Benefits of Saving Accounts

- It helps you to be more financially responsible

- It helps you to save money and make some money on the savings

- It helps you to plan for the future

- It helps you to save time

- It is a good habit that can help you in the long run.

Savings Accounts vs. Checking Accounts

Savings accounts are typically used for saving up money. Checking accounts are typically used for making payments and spending money. Saving account pays interest on the balance. It’s also called a deposit account and sometimes called a deposit saving or term deposit.

Checking account is another type of bank account, but it’s used more for day-to-day transactions like paying bills and buying groceries. It lets you write checks, use debit cards, and access your funds through an ATM. It’s also called a demand account or current account.

Types of Interest Rates On Deposit Accounts

There are different types of interest rates on deposit accounts. The rates of interest may vary depending on the amount deposited and the time period.

The most common types of interest rates on deposit accounts are:

– Fixed Interest Rate

– Variable Interest Rate

– Compound Interest Rate

How Do Banks Make Money on Savings Accounts?

Banks make money on savings accounts by paying a lower interest rate than they charge for loans. This is because banks are not required to pay the same level of interest to depositors as they are allowed to charge for loans. The difference between these two rates is actually called the “spread.”

The spread can be either positive or negative, depending on which direction interest rates move in relation to one another. 3 ways banks make money on savings accounts are:

1) Profit from Interest

Banks can earn income on a savings account is through interest payments, which are calculated based on how much the bank pays to borrow funds from other institutions or individuals, and then invest those funds in order to generate a profit.

2) Fees

Banks charge fees for many activities that take place on your savings account, such as ATM withdrawals, debit card transactions, overdrafts, and wire transfers. These fees are largely unregulated by law so they can be quite high – often in the range of $5-10 per transaction.

3) Lending and Investing

Banks also make profit lending out the spare cash they have on hand to other people or businesses. They also use the spare cash for short term investing purpose. They can not use saving accounts cash for long term investment.

How to Determine the Annual Percentage Yield (APY) for a Savings Account?

The annual percentage yield (APY) is a measure of the interest rate on an investment. It is the rate of return on an investment, expressed as a percentage, that takes into account the effect of compounding interest over a year.

The APY is one way to compare investments with different rates and terms. For example, if you invest $1,000 in two different accounts that both have an APY of 2%, but one account has a term of 6 months while the other has a term of 12 months, the account with the higher APY will earn more money over time because it compounds at a faster rate.

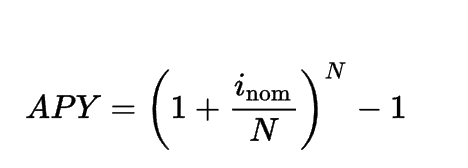

In order to determine how much you will earn in interest each year on your savings account based on its annual percentage yield (APY), you can use this formula:

Which Account is Beneficial for Banks: Savings Accounts or FD Accounts?

Banks make profit on both the normal saving accounts and fixed deposit accounts. Banks make profit from the interest rates they offer on a savings account. For example, if the interest rate is 4% per annum, then a bank will earn 4% of the initial deposit every year.

Banks also make profit from fixed deposits. The longer you invest in a fixed deposit, the higher the interest rates offered by banks and hence higher profits for them. But, as compared to normal saving accounts, fixed deposit accounts are more beneficial for banks. Because they can use FD amounts for lending purpose and lending is the main source of income for banks.

So, this is “How Do Banks Make Money on Savings Accounts?”. If there is any confusion regarding any above discussed topic, you can put a comment below. Thank You!

Read Our Other Articles:

Why Stock Market Crashes? Top 5 Possible Reasons