HDFC Bank is one of the leading private sector bank in India. It offers a range of financial services to the customers. It has been in the banking industry for more than three decades. The Bank’s credit card offers multiple advantages with its reward points and cash back programs, which makes it one of the best credit cards in India.

HDFC Bank Credit Card has a very low annual fee, which makes it an attractive option for people who are looking for a card that doesn’t have high annual fees. The credit card is one of the most sought-after credit cards in India.

Why HDFC Bank Credit Card is Better Than Any Other Bank

The main reason why HDFC Bank Credit Card is better than any other bank is because they have a very low interest rate.

The interest rates are lower than any other bank and the balance transfer fee is also lower. When you make a purchase, the interest rate is zero. This means that you don’t have to worry about paying high interests when you make purchases.

HDFC Bank Credit Card has a very fair policy when it comes to balance transfers. You can transfer your balance for free for three months without being charged with any fees or interest rates.

It also offers a range of benefits such as cashless transactions, fee waiver, free international transactions and more.

Which Types of HDFC Credit Card is Best For You

There are many types of credit cards offered by HDFC bank in 2022. Types of credit cards are:

- MoneyBack+ Credit Card – The Most Rewarding Card For Everyday Spends

- Regalia Credit Card – Luxurious Indulgences. Ready For You.

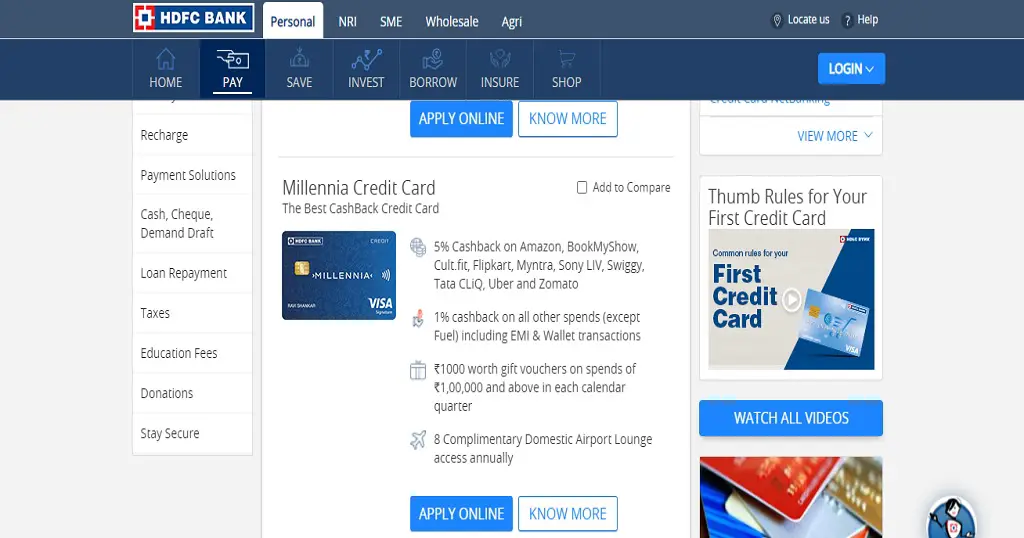

- Millennia Credit Card – It is the Best CashBack Credit Card

- Tata Neu Plus HDFC Bank Credit Card – Provides Extraordinary Rewards. Ready for You.

- Tata Neu Infinity HDFC Bank Credit Card – Extraordinary Rewards. Ready for You.

So, these are the types of credit cards offered by HDFC bank. According to your need and requirements, you can choose one. For me the best credit card is Millennia credit card because it offers high cashback as compared to other. It provides up to 5% cashback offer.

HDFC Credit Card How to Apply: 3 Most Easy Methods

Before applying for credit card, first of all choose which type of credit card is best for you. Some credit card can be best for travel, some for entertainment and some for business. After that make sure you are eligible to receive credit card from HDFC bank.

If you are not an existing customer, the bank will ask you necessary documents such as identity, income and address proofs.

3 Methods to Apply for HDFC Credit Cards are:

- You can apply for HDFC credit card online

- You can apply for credit card at HDFC ATM

- You can visit your nearest HDFC credit card with necessary documents.

How to Apply For HDFC Credit Card Online:

> Go to https://www.hdfcbank.com/personal/pay/cards/credit-cards

> Choose the type of credit card which is best for you and click on apply now

> A new tab will open, fill up all the necessary details there in all the 4 steps and click on submit.

> You will receive a message if your application is approved or not.

> After that the card is delivered to your communication address and you have to show your identity proof to receive the card.

> You get a green pin to your registered mobile number and a pin is also couriered to you separately.

> Once you receive the card and pin, you have to activate it. You can visit nearest ATM and change your pin there to activate the card.

Why HDFC Credit Card Application Gets Declined

It’s very common for a credit card application to get declined. Here are some of the most common reasons why your application might get declined:

– You have too many credit cards and you need to cut down on the number of cards you have.

– Your income is too low and you don’t make enough money to be able to afford the monthly payments.

– You have too many debts and your debt-to-credit ratio is too high.

– You’re not in good standing with your current lender.

Things to Know Before Getting A Credit Card

Credit cards are a useful form of credit and can be used to make purchases or withdraw cash. You should have a credit card in order to be able to make purchases online, rent cars, and stay at hotels.

There are many things that you need to know before getting a credit card. You should know your spending habits before applying for a credit card so that you can get the right one for your needs. You should also compare different offers in order to find the best deal.

We recommend that you have an emergency fund of at least $1000 before getting a credit card because it will help you avoid paying high interest rates on your monthly balance if you ever fall behind on payments.

How to Get a Debit Card at 14 & 16? 2 Easy Methods

How to Use HDFC Credit Card Reward Points

Why Use PayPal Instead of Credit Card and Debit Card: 10 Reasons